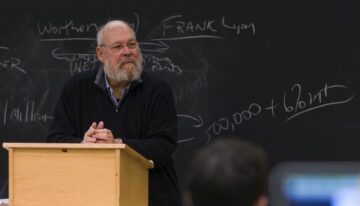

Michael J. Graetz

Michael J. Graetz

Michael J. Graetz, Professor Emeritus at Columbia Law School and Professor Emeritus and Professorial Lecturer at Yale Law Schools, is a leading expert on national and international tax law.

His new book, The Power to Destroy—How the Antitax Movement Hijacked America was published in February 2024 by Princeton University Press. Other recent scholarship, including his book The Wolf at the Door: The Menace of Economic Security and How to Fight It (with Ian Shapiro, Harvard University Press, 2020) has focused on issues of economic inequality and insecurity. Graetz has written a number of books on federal domestic and international taxation, including a leading law school text, in addition to books on the Supreme Court, energy policy and social insurance along with nearly 100 articles on a wide range of domestic and international taxation, health policy, and social insurance issues.

After teaching at Yale Law School for more than 25 years, Graetz joined the Columbia Law School faculty in 2009. Before his time at Yale, Graetz was Professor of Law and Social Sciences at the California Institute of Technology, and a professor of Law at the University of Southern California and the University of Virginia.

In addition to his academic career, Graetz has held several positions in the federal government. He was assistant to the secretary and special counsel for the Department of the Treasury in 1992, and deputy assistant secretary for tax policy at the Department of the Treasury from 1990 to 1992.

Graetz is a fellow of the American Academy of Arts & Sciences and was a John Simon Guggenheim Memorial Fellow. He received an award from Esquire Magazine for work in connection with the provision of shelter for the homeless. He was awarded the Daniel M. Holland Medal by the National Tax Association for outstanding contributions to the study and practice of public finance and was the first law professor to receive the Distinguished Service Award from the Tax Foundation.

Graetz earned his J.D. from the University of Virginia and his B.B.A. from Emory University.

Senator Ronald Wyden, Oregon

Senator Ron Wyden

U.S. Senator Ron Wyden (D-OR) is the Chair of the Senate Finance Committee and senior member of the Energy and Natural Resources Committee. Throughout his time in the Senate, he has been a committed champion for climate action, lower health care costs, and a fair and equitable tax code.

Senator Wyden’s priorities as leader of the Finance Committee are guided by the simple idea that all Americans should be treated equally, but for too long the tax code has maintained a different set of rules for working people than it does for the wealthy. Senator Wyden sought to address this core unfairness with his Billionaires Income Tax proposal, introduced in 2023.

Always citing the need to “throw open the doors of government,” he holds an open-to-all town hall meeting in each of Oregon’s 36 counties each year. Thus far he has held more than 1,000 meetings. Wyden’s dedication to hearing all sides of an issue and looking for common sense, non-partisan solutions has won him trust on both sides of the aisle.

Wyden began college at the University of California-Santa Barbara where he won a basketball scholarship and played in Division I competition for two seasons before transferring to Stanford University where he completed his Bachelors degree with distinction. He earned his law degree from the University of Oregon School of Law in 1974, after which he taught gerontology and co-founded the Oregon chapter of the Gray Panthers, an advocacy group for the elderly. Wyden was first elected to the Senate in 1996.

![National Tax Association [ National Tax Association ]](https://ntanet.org/wp-content/themes/nta-custom/library/images/nta-whitebg-web-top.svg)

![National Tax Association [ NTA ]](https://ntanet.org/wp-content/themes/nta-custom/library/images/nta-white-logo.svg)